Dear Diary, it’s the Beggar King.

Since I’m still pretty excited about this blogging thing, I am writing this right after the introduction. I hope this lasts…

I started working very late compared to most people on the planet. At 27 years 3 months old, I was so far behind everyone else, it ain’t even funny. I had to compensate by being smart with munny. And that brings me to the topic…

Today I wanna talk about how I keep track of my munnys.

About a year and half ago, that’s a year and half after I started working, I randomly decided to open up an excel sheet to write down a balance sheet, and have been maintaining it since. Yeah, you might think I didn’t have anything better to do, and you would be right. I can no longer remember what my motivation was at that point of time, but me thinks it doesn’t matter anymore. I formed a good habit, and that’s what matters.

I successfully predicted how much savings I would have today since a year ago, with an error of only about $1000. Stonks.

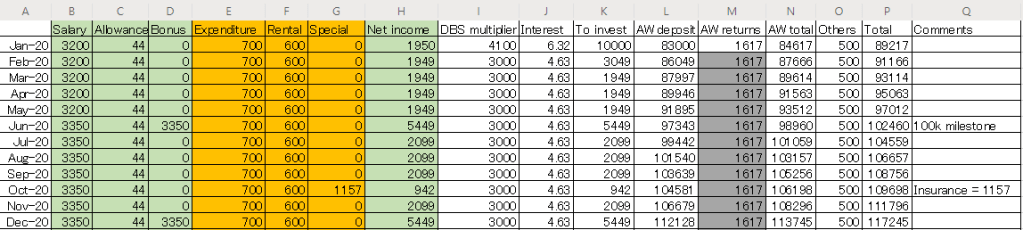

This is how I do it. Just good ol’ Excel. There are probably plenty of budget planner apps out there, but what can you do, I’m old fashioned. #Boomer

To break it down… I start by figuring out my net income each month. This is simply cash inflow – cash outflow.

Inflow : Salary + allowance + bonus

- Salary : Not much to explain here. For Singaporeans, this is 80% of your salary on paper. The other 37% goes to CPF. I don’t take CPF into consideration as I have no way to tap on it yet.

- Allowance. I have transport allowance. Others might get meal allowance and whatnot, but that is all I get. I separated it from salary as they are not factored in bonus salaries.

- Bonus : Additional salary. Varies greatly between individuals, but I get at least 2 months a year.

- Other income : If necessary, you could also include another column for “other income” here. Irregular income from outside your day job such as side hustles or Youtube. For me, I sell games on Carousell and make a small amount of money, like $50 a month. It’s quite negligible so I did not include it. If I start making about $100 a month from side-incomes I would add a column for it.

Outflow : Regular expenditure + mortgage/rental + special expenditure

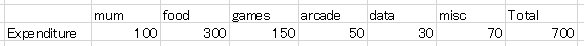

- Regular expenditure : All fixed monthly expenditure. Food, mobile data, hobbies, and so on. Mine looks like this.

- Mum : I only give mum $100 a month. I told her right at the start that I want to save up a huge amount of $$$ to buy a house first. The same amount of money is worth a lot more in my hands than in hers.

- Food : I spend $300 for food a month, about $10 a day. I don’t eat breakfast, so that’s basically $5 for two meals. That’s not too hard in Singapore. I almost don’t ever buy drinks; I carry a bottle of plain water wherever I go.

I do eat more expensive stuff occasionally, but I would compensate for it by eating cheap stuff another day. This is just a general rule of thumb; I don’t stick to it that much. If I do go over $300, there’s the “misc.” expenditure to help cover it. - Hobbies : This should be the largest component for most people’s regular expenditure, as is mine. I’m a pretty hardcore gamer, so a big chunk of my expenditure goes to physical/digital games, as well as arcade gaming. This is the one and only thing I splurge on, although I have learnt to make money out of my hobbies not long after I picked up this hobby. I do so by buying games cheaply and selling them for good profit, with about 20-40% markup. I think anyone can do this with any kind of physical items if they bother do.

- Misc. : Miscellaneous expenditure is expenditure I can’t predict. Things like weddings, red packets, clinic visits, overspending, and so on. Put a bigger number here if you can’t estimate your expenditure well, or if you have a tendency to spend impulsively.

Generally, you should try to be very conservative with your expenditure estimate. It’s too easy to overspend. You could add 10% of your initial estimate to misc. Or just add 10% to every category. Accuracy is key here.

- Rental/mortgage/loans : This is for rental/mortgage or any other kinds of loan payments. You could split up loans into separate columns. Even though this is also regular expenditure, there is not much you can do to reduce it, hence the separate column.

- Special expenditure : This will be relatively large, irregular, and/or unavoidable expenditure. Such as buying a new phone, a new PC, or insurance premium payment. Unlike “misc.”, it should be for large expenditure, because it can really rekt your net income of that month. Having a separate column makes it more visible, and helps draw your attention to it whenever you look at your balance sheet.

After you have gotten all of it down for a month, continue by filling as many rows as you desire. For a start, perhaps you could fill up from Jan-Dec 2020, like in my example. You will now have your monthly net income for the entire year. Sum those up, and you will have a very simplified total savings for 2020! If your estimates are good enough, you ought to come within +/- 10% of the end result come December.

It’s also possible to start from the end, and work backwards. Write down a target savings for December, fill in the cash inflow, and calculate the resulting expenditure for each month. Adjust components of expenditure until it is equal to the resulting expenditure, and them just stick to the plan.

Long term goals are good to have. For example, mine are :

- $100,000 by 30 years old (almost achieved)

- $250,000 by 35 years old. Buy a house, rent out 2 rooms.

- Retire by 40 years old with $500,000, and have a monthly passive income of $3000-4000 from investments and rent.

I am absolutely certain that I can achieve my goals, because I have almost achieved one of them, and the next two are simply taken from the balance sheet projected 5 and 10 years ahead. Achieving them is just a matter of sticking to the plan. Also, planning goals in short intervals makes them less intimidating, and makes expenditure easier to adjust if necessary. Why not set some goals for yourself? It’s surprisingly fun! 😀

I shall move on to the remaining columns another day~ Ciao!

————————————————————————————————-

Beggar King notes:

- It might sound simple, but it is really quite a challenge to figure out all sources of one’s expenditure. Perhaps you could try to note down all your expenditure for a month, or keep all receipts. One thing I do is to buy everything with a credit card, so I can easily check all my expenditure on my banking app. If you use cash, you can easily lose track of where your munny went. Although credit cards do come with many problems, especially with people with no discipline.

- It’s okay to ignore inflation. Singapore’s savings accounts have good interest rates that easily beats the low inflation rate. More on this topic another day.

One thought on “Personal Balance Sheet (Part 1)”